Get the best help and no obligation High Risk Box Truck Insurance or Straight truck insurance rate quotes started right now!

Get High Risk Box Truck Insurance quotes started right now!

Send in a request for more information with the quick New Startup or High Risk truck Insurance request form below for any type of coverage. We have box and straight truck insurance for all different sizes.

Get High Risk Box Truck Insurance quotes started right now (855) 235-2321 and (888) 443-7623 !

What is high risk truck insurance and who needs it? Higher SAFER scores]

Commercial Insurance Agencies has been a leader and expert in the high risk box truck insurance markets since 2004. We have helped thousands stay on the road making money and we’ll be glad to help your company also. Using our service is free and we will provide expert service and fast certificates once you have your policy with us

Get help with HIGH RISK commercial trucking insurance needs!

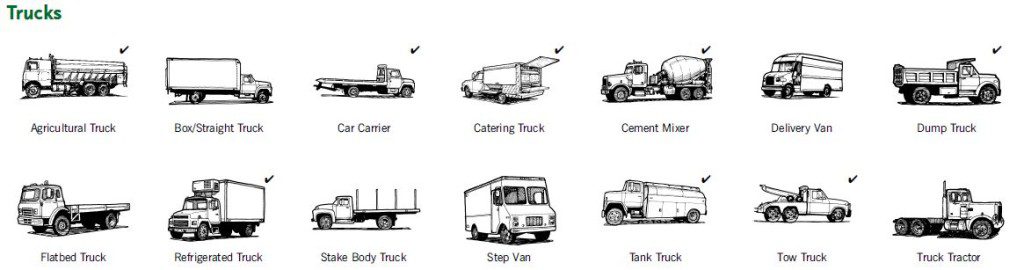

Trucking For Hire: – Car Carriers – Fuel Oil Haulers Gasoline, Diesel & Airplane Fuel Haulers -Ag Haulers (including livestock) – LPG, Butane & Propane Haulers Bulk or Bottled • Dumping Operations – • Contractors – • Tow Trucks – • Caterers – • Cement Mixers -• Concrete Pumper Trucks – • Couriers • Custom Harvesters • Farm to Market Trucking – • Farmers – • Food Delivery – • Grain Haulers – • House Movers – • Lawn & Tree Service – • Logging – • Mobile Concessions – • Mobile Equipment – • Mobile Home Toters – • Moving Operations – • Pulpwood Haulers – • Salvage Haulers – • Specialized Delivery • Snow Plows – • Truckers Contingent Liability (Bobtail or Deadhead) – • Waste Oil Haulers • Wholesalers & Manufacturers.

Get immediate High Risk Box Truck Insurance Help if you have any of the following, New CDL drivers, Need new venture truck insurance, Have poor credit scores, Coming out of state assigned risk pool, Need high risk cargo coverage, Need FR44 or SR22 insurance filing, You have high out of service percentages (OOS), Have elevated CAB scores, Showing multiple alerts, Have a conditional safety ratings, Have high loss frequency, Faced with truck insurance cancellation by current insurer, Have large shock losses, Have high CSA scores or Bad SMS scores.

Trucking by design is a higher risk than other business types and could be fraught with speculative danger. It is a business that offers freedom on the open road, the ability to be your own boss, and the sometimes difficult task of buying higher risk trucking insurance!

As industry experts we offer Higher Risk Box Truck Insurance and provide quotes for commercial vehicles including Big Rig Semi’s, Straight Trucks, Box Trucks, Dump Trucks contractors vehicles and much more.

We have commercial box and straight truck insurance for those with a bad driving record and even a DUI. Compare our programs now and learn what high risk truck insurance is, whether it is good for your business and what it has to offer you.

We’ll help you purchase state or federally mandated insurance for new venture truckers (typically considered unsafe and at risk due to uncertain experience).

We also insure those that have accidents or at risk of multiple moving violations on their license. Our company may also insure risky drivers with less than 2 years of CDL exposure. We have hazardous truck driving carrier insurance and commercial truck insurance offers for those with convictions that cause perilous problems to get insured.

You are probably considered high risk if you have high out of service percentages (OOS), Have elevated CAB scores, Showing multiple alerts, Have a conditional safety ratings, Have high loss frequency, Faced with truck insurance cancellation by current insurer, Have large shock losses, Have high CSA scores or Bad SMS scores.

Other High Risk Box Truck Insurance coverage’s that may be bought include:

Compare High Risk Comprehensive – Protection for the loss of or damage to your vehicle and its equipment from all causes except collision, subject to the deductible on the policy.

Add High Risk Collision – Protection for the collision damage to your automobile and its equipment, subject to the deductible on the policy.

Uninsured Motorist – This Coverage allows you to recover bodily injury damages due to an accident where the other party does not have insurance, and is found legally liable.

Under-insured Motorist – This Coverage allows you to recover bodily injury damages due to an accident where the other party is found legally liable and does not have adequate liability limits.

Additional Expense – Coverage for necessary additional expenses incurred as a result of a loss for which you are protected under comprehensive or collision coverage. These expenses include rental cars, food, lodging and other incidental expenses.

Hired Auto Liability Coverage – Covers liability for automobiles hired under contract on behalf of or loaned to the named insured.

Possible Hired Auto Physical Damage – Coverage for an automobile of any type, hired, borrowed or leased on a short term basis for use in the insured’s business.

Employer’s Non-Ownership Liability – Coverage for a private-passenger automobile used in the business of the named insured by any person, or the occasional and infrequent use of a commercial automobile in the business by any of your employees.

Typically High Risk Motor truck cargo coverage is available as a package or standalone coverage just like physical damage coverage’s.

Auto physical damage, hired & non-owned, motor truck cargo, terminal operations, excess coverage available.

We have the resources to help you get what you need to insure your box or straight truck. Simply start the help process by using our easy contact form and we will get right to work for you.

If you need regular or preferred commercial truck insurance please visit Big Rig Insurance Brokers.Com

High Risk Box Truck Insurance Quotes in Alabama, Arkansas, Delaware, Florida, Georgia, Iowa, Indiana, Kansas, Kentucky, Maine, Maryland, Mississippi, Missouri, Nebraska, New Jersey, North Carolina, Ohio, Pennsylvania, South Carolina, Tennessee, Texas and Virginia available here.

Quotes| Alabama| California| Delaware| Florida | Illinois | Indiana | Kansas | Maryland| Missouri | Nebraska | New Jersey | New York| North Carolina | Ohio | Oklahoma | Pennsylvania | South Carolina | South Dakota | Texas |